Gross Wages Gross Working Capital Ground Lease Group Columns in Excel Group Data in Excel Group in Excel. And keeping a simple sleep log for one week heres our sleep diary worksheet can help you determine any issues with sleep.

How To Calculate Your Net Salary Using Excel Salary Excel Ads

Continued calculating gross pay worksheet answers We use many processing centers in different cities and countries which ensures a huge selection of numbers for SMS activation provided to you as well as uninterrupted operation of the site.

. This is a ready-to-use template that you can manage your timesheet. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. This is done by calculating and entering the accumulated kilograms per grade up to the quarter on each Members Produce Record.

Accordingly this post describes a quick-and-dirty approach to simply easily and correctly prepare payroll for a. Do the same for your spouses wages and add it to your amount if you are married and plan to file jointly. Using the fact that Social Security tax is 62 of gross pay Medicare tax is 145 of gross pay and state tax is 19 of federal tax determine if Juanitas net pay is correct.

The following is for employees using a time clock. Gross payment journal 3. Look at your pay stub from your employer under gross amount This is before any other deductions are taken out.

We would like to show you a description here but the site wont allow us. Bankrate has the advice information and tools to help make all of your personal finance decisions. For 2011 the amount is 452 a week.

Academiaedu is a platform for academics to share research papers. You can specify the start and end time regular time hours overtime charges as well as weekends. Multiple choice answers A and C overlooked the discount that was allowed.

Note the time you go to bed and the time you wake up. Member Produce Record 2. Summary report for total hours and total pay.

Answer D was incorrect in only allowing 20 days instead of 30 days for a payment without a discount. Gross pay includes not only salary but also other forms of income such as bonuses commissions or severance pay. If you are paid weekly multiply the weekly gross amount by 52.

Assuming a Medicare tax rate of 145 and monthly gross wages of 4100 the amount recorded in Medicare Tax Payable for one quarter for the employees payroll. Control your personal finances. Decrease wages in your covered period for employees earning 100000 or less annualized per pay period in 2019 by more than 25 when compared to an employees average weekly salary wages during the first Quarter the SalaryHourly Wage Reduction Adjustment Do not use 60 of your loan amount on payroll costs.

Accounting Worksheet Accounts Payable Credit or Debit Accounts Payable Cycle. Employee wages are reviewed yearly. On line 1 of the worksheet enter the number from line G of the Personal Allowances Worksheet or line 10 of the Deductions Adjustments and Additional Income Worksheet if used.

AThe net pay is correct. Using Table 1 in the Multiple PensionsMore-Than-One-Income Worksheet find the number that applies to the lowest paying pension or job and enter it on line 2. Choose the true statement below.

Therefore the tax rate on these wages is 62. We are not dependent on the work of. Continued calculating gross pay worksheet answers.

Add tip income to wages before applying conversion factors. Free online gross pay salary calculator plus calculators for exponents math fractions factoring plane geometry solid geometry algebra finance and more. Major Occupational Groups Note--clicking a link will scroll the page to the occupational group.

You can find more details on Modified AGI from the IRS here or you can see the form 8962 instructions for calculating Modified AGI for the tax credit TIP. Use the following formula to calculate this amount. Disposable Income Gross Pay Mandatory Deductions.

13-0000 Business and Financial Operations. A maximum weekly benefit amount is established each year. A claimant is entitled to a weekly benefit amount WBA equal to 126th of the highest quarter wages in the base period.

Excel Weekly Planner Template Excel Worksheet Merge Excel Worksheet Tab Excess Reserves. The employees review date is typically on or about the anniversary date of employment or the date of the previous compensation review although reviews may be conducted more often depending on the circumstances 42 Timekeeping. Download FREE Excel Timesheet Calculator Template.

Qualified sick leave wages and qualified family leave wages for leave taken after March 31 2020 and before April 1 2021 arent subject to the employer share of social security tax. Calculate the gross amount of pay based on hours worked and rate of pay including overtime. You will use this amount in calculating the employees allowable disposable income.

MAGI is used to determine ObamaCares cost assistance and to claim and adjust tax credits on the Premium Tax Credit Form 8962. Juanita receives her paycheck and knows that her gross pay and federal tax are correct. Additional information including the hourly and annual 10th 25th 75th and 90th percentile wages is available in the downloadable XLS file.

Click to get the latest Buzzing content. Not every one-person corporation pays or even can pay an annual salary of 40000 to the shareholder-employee. Use command find on those documents to find what you are looking for.

Multiply the monthly wages by 12 to get the annual amount. At the same time all information copied on a gross payment journal is carried on a summary of gross payment journal. A dynamic Excel template for calculating employee working hours and overtime.

Tip Income Count the actual not taxable gross amount of tips as earned income. Take A Sneak Peak At The Movies Coming Out This Week 812 Minneapolis-St. But a salary of 40000 it turns out is roughly the average salary paid by a single-shareholder S corporation to its shareholder-employee.

Forms and equipment to be used. This lets us find the. Tip income is income earned in addition to wages paid by patrons to people employed in service-related occupations such as beauticians waiters valets pizza delivery staff etc.

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Templates Excel Templates

Compound Interest Maze 8th Grade Math Worksheets Simple Interest Math Word Problem Worksheets

Trial Balance Template Excel Download Is Ready Use It For Unadjusted And Adjusted Trial Balance Income Sta Trial Balance Balance Sheet Template Balance Sheet

Basic Wage And Overtime Pay Worksheet

Employee Payroll Budget Worksheet Template Budgeting Worksheets Worksheet Template Budget Template Free

Inventory Analysis Templates 8 Free Docs Xlsx Pdf Analysis Templates Printable Free Templates

Payslip Templates 28 Free Printable Excel Word Formats Templates Business Template Excel Templates

Microsoft Word Calculatingwages Calculating Gross And Weekly Wages Worksheet Name Group Members A Salary 1 Maria S Job Pays Her 1500 A Month What Course Hero

Quiz Worksheet Calculating Payroll Costs Study Com

Maria 39 S Job Pays Her 15000 A Month What Is Her Gross Weekly Wage 2 John Receives 1 108 A Day What Is His Gross Weekly Wage If He Works Course Hero

Calculating Your Paycheck Salary Worksheet 1 Answer Key Fill Out And Sign Printable Pdf Template Signnow In 2021 Paycheck Printable Signs Salary

Download Salary Sheet Excel Template Exceldatapro Excel Templates Payroll Template Worksheet Template

Timesheet Excel Templates 1 Week 2 Weeks And Monthly Versions Timesheet Template Excel Templates Payroll Template

Basic Income Statement Template Beautiful Basic In E Statement Depreciation Income Statement Statement Template Profit And Loss Statement

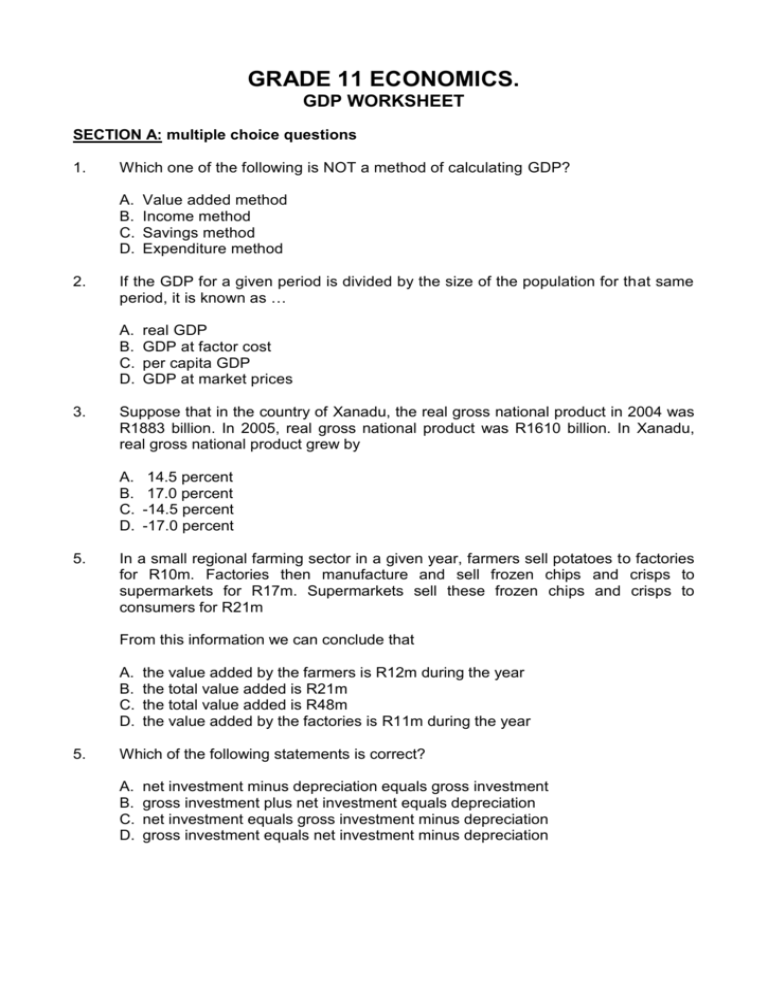

Grade 11 Economics Gdp Worksheet

Free Printable Income And Expense Worksheet Pdf From Vertex42 Com Budgeting Worksheets Expense Tracker Printable Printable Budget Worksheet

Record Retention Schedule Templates 11 Free Docs Xlsx Pdf Schedule Templates Schedule Template Excel Templates

Grammar Practice Worksheet Free Printable Educational Worksheet Grammar Worksheets High School Capitalization Worksheets Grammar Worksheets

Tidak ada komentar:

Posting Komentar